Daniel Kushnir, Illya Nayshevskyy, Ph.D., Jackson Reiter

Sep 12, 2024

Abstract

This study investigates the relationship between the number of days properties remain on the market and the resulting change in price between listing and sale. Utilizing a comprehensive dataset of residential real estate homes sold between January 1, 2024, and April 30, 2024, this research examines not only the interplay of various numerical variables but also the differences across states, offering a unique perspective on the U.S. real estate market. The findings contribute to understanding how pricing dynamics affect market behavior and how home sellers might optimize their profits.

Introduction

The real estate market is inherently complex, with numerous factors influencing the sale of a property. One critical aspect is the duration a property remains on the market and how this impacts the final sale price. This study aims to explore this relationship by analyzing a robust dataset of residential properties sold in the first four months of 2024. By examining correlations between days on market, price changes, and other relevant variables, this research provides insights that could guide sellers and real estate professionals in making informed decisions.

Methods

Data for this study were drawn from an internal, comprehensive database of residential properties. The following steps outline the data processing and analysis approach:

Data Collection: The dataset was queried to include all residential, single-family homes sold within the specified period.

Data Filtering: The dataset was filtered to exclude incomplete data, auctioned homes, and properties outside the designated date range. Due to a lack of complete data, 12 states were excluded from the study ('AK', 'ID', 'KS', 'LA', 'MS', 'MO', 'MT', 'NM', 'ND', 'TX', 'UT', 'WY').

Data Curation: The data was curated to a simplified format, focusing on two primary columns: the number of days on market and the price change between listing and sale.

Data Compilation: Various metrics were compiled, including the Ordinary Least Squares (OLS) function of price change versus days on market, the percentage of homes sold above the listing price, average days on market, average price change, average number of price changes, and the ratio of removed listings to sold listings.

Data Analysis: The data was analyzed to identify significant correlations between the variables mentioned above. Multiple variable relationships were graphed and interpreted to form conclusions that consider both numerical data and state-level differences.

Results

The analysis revealed several key findings:

There is a somewhat strong negative correlation between the average days on market and the price change, indicating that properties remaining on the market longer tend to sell for less than their original listing price.

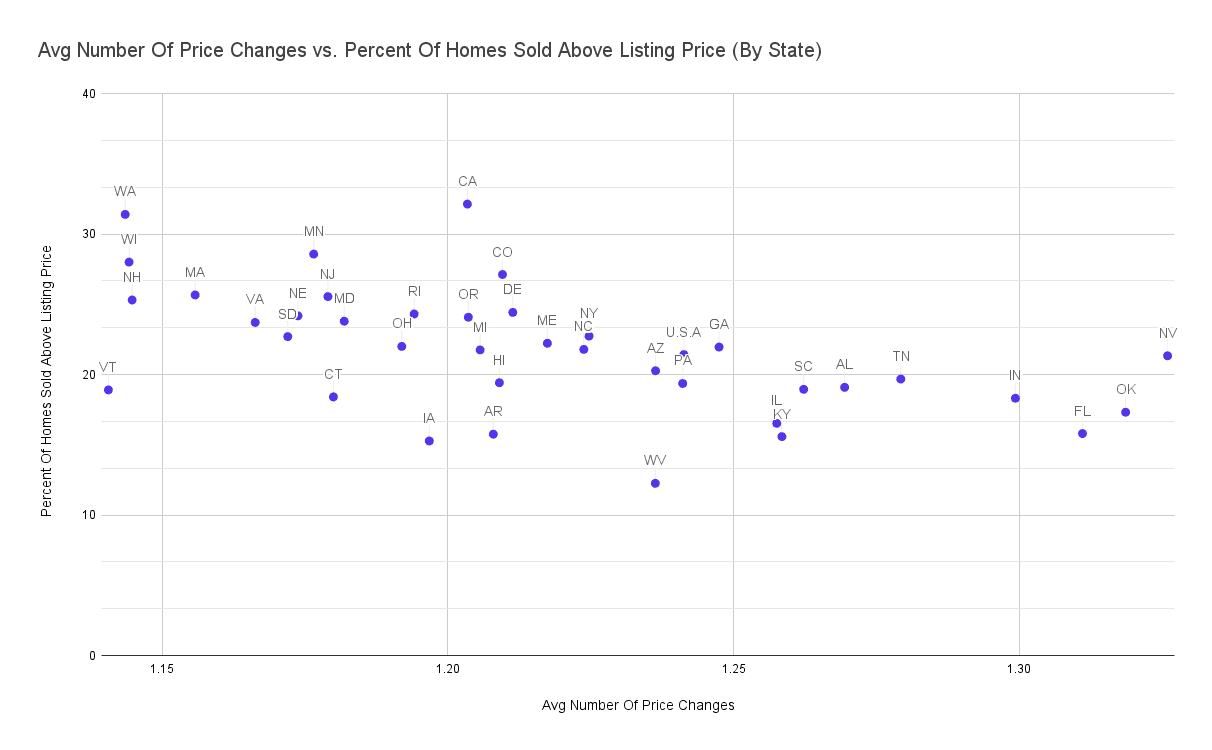

The average number of price changes is negatively correlated with both the average price change and the percentage of homes sold above the listing price. This suggests that properties with fewer price changes are more likely to sell at or above their listing price.

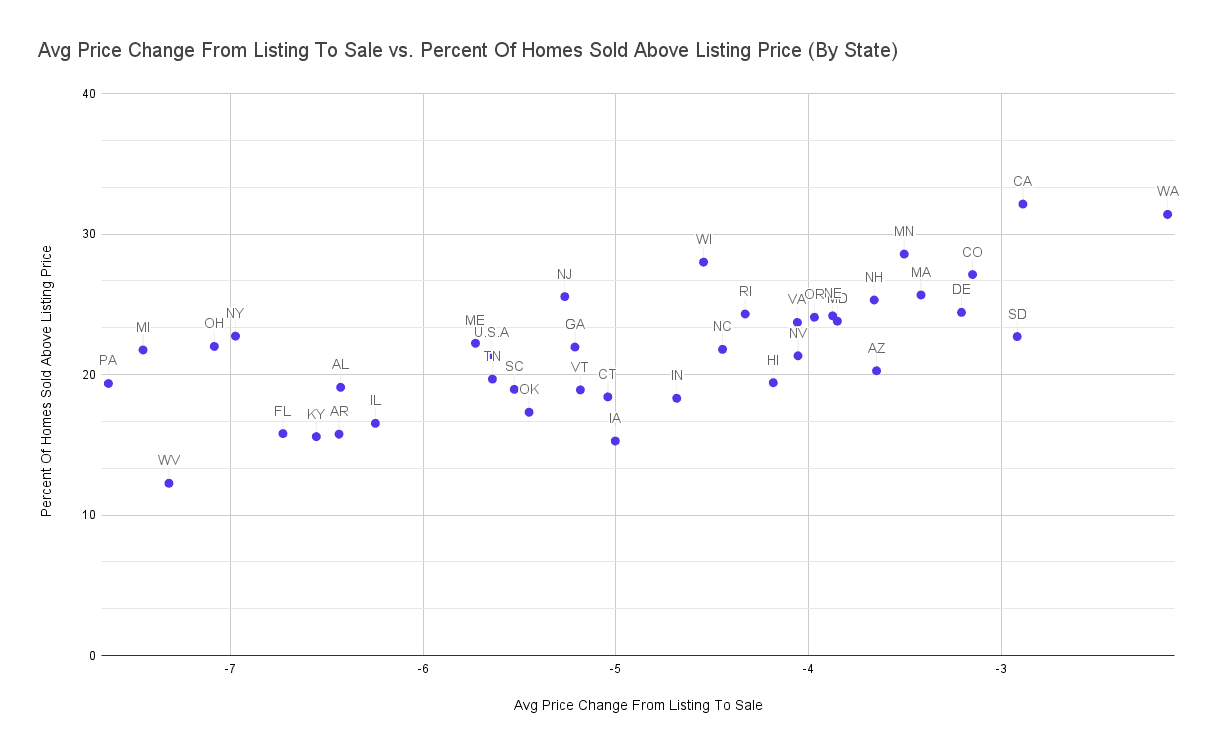

A significant correlation was found between the average price change between initial listing and final sale price and the percentage of homes sold above the listing price.

The number of complete data points (also referred to as total number of completed sales events) and the number of total homes in the dataset are strongly positively correlated with the number of auctioned homes, descriptively reflecting higher competition in the market.

There is a moderate positive correlation between the average number of price changes and the number of homes in the dataset, indicating that more competitive markets may lead to more frequent price adjustments.

The ratio of removed listings to sold listings did not show significant correlations, suggesting no predictable relationship with sales outcomes.

Discussion

The negative correlation between average days on market and price change suggests that properties staying longer on the market tend to see reductions in their final sale price. This trend indicates that sellers may need to lower their prices over time to attract buyers, leading to potential losses.

The correlation between fewer price changes and a higher percentage of homes selling above their listing price implies that maintaining the original listing price could result in more favorable outcomes. This trend may reflect stronger market demand or more accurate initial pricing strategies.

The significant correlation between average price change and the percentage of homes with a price increase further highlights the importance of setting the right price from the start. Properties that experience price appreciation typically spend less time on the market.

The observed positive correlation between the number of homes in the dataset and the average number of price changes suggests that in competitive markets, sellers may be more inclined to adjust prices frequently to remain competitive.

The lack of significant correlations between the ratio of removed listings to sold listings and other variables suggests that delisted properties do not have a predictable impact on overall market behavior. This could be due to various factors influencing delistings across different regions.

These findings provide valuable insights for real estate professionals, suggesting that strategic price adjustments and initial pricing accuracy can significantly influence sales outcomes. Additionally, the study underscores the importance of considering regional market conditions when developing pricing strategies.

Conclusion

This study offers a detailed analysis of how the duration a property remains on the market affects its final sale price. By examining various correlations within the dataset, the research highlights the critical role of initial pricing and the impact of market competition on pricing strategies. The findings can inform real estate professionals and sellers on optimizing pricing to achieve better financial outcomes, particularly in competitive markets.

Future research could further explore the regional differences identified in this study, providing more localized insights into real estate market dynamics.